August 19, 2008 – New York, NY – Hennessee Group LLC, an adviser to hedge fund investors, expects “inflation will not be as significant as the Fed stated at their last policy meeting two weeks ago”, commented Charles Gradante, Co-Founder of the Hennessee Group. “We expect the Fed to keep official rates steady into next year, and if global GDP growth doesn’t pick up (especially in the U.S. and Euro Zone), we may even see a decline in U.S. rates”, said Charles Gradante. Assuming we don’t get a resurgence in energy and food prices, we will see a decline in headline inflation (which includes energy and food). It is highly unlikely that inflation can coexist with:

|

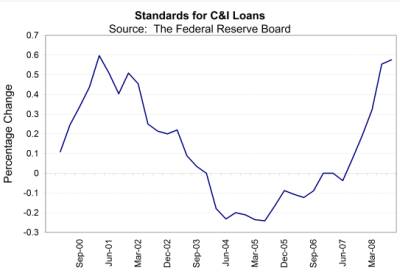

Tightening credit standards for commercial and industrial lending; |

|

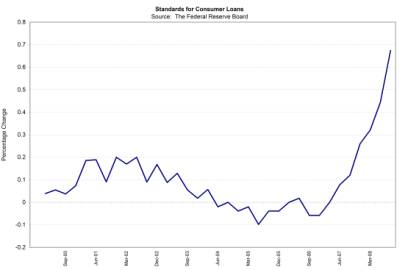

Tightening credit standards for consumer loans; |

|

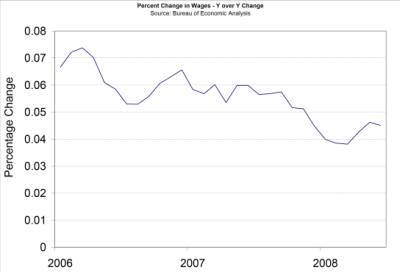

Declining wage growth; |

|

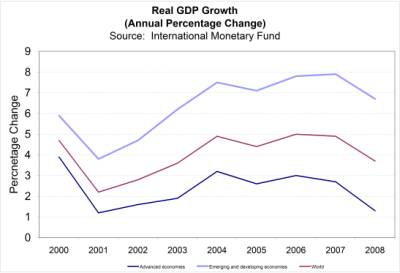

Declining GDP; |

|

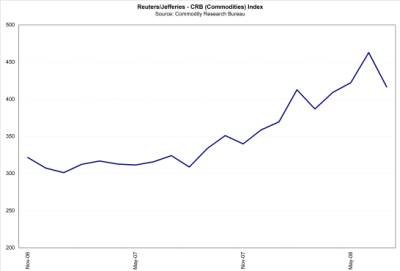

Declining commodity prices since mid 2008; |

|

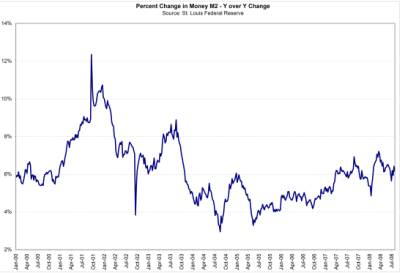

Neutral monetary policy; |

|

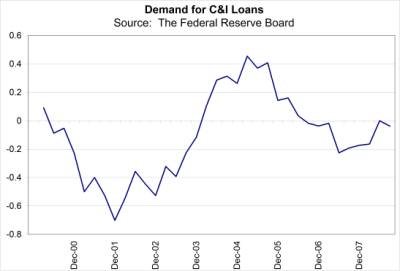

And, low demand for commercial and industrial loan. |

Stagflation Cycle is Coming to an End

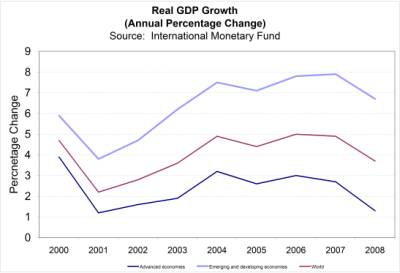

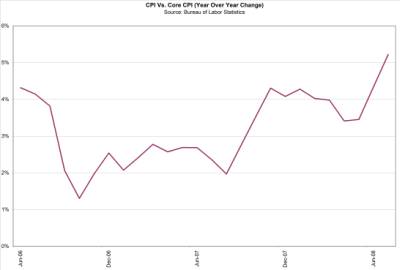

The Hennessee Group has been reporting to its clients that the U.S. has been in a moderate stagflation not inflationary economic cycle. The CPI (headline consumer price index) rose +0.8% in July, double what economists had expected and at levels not seen since January. Inflation rose at +5.6%, year-over-year, the fastest pace registered in 17 years. GDP growth has been declining since the middle of 2007 in advanced economies and emerging/developing economies while energy and food prices have risen. Stagflation is:

|

Slowing GDP growth; |

|

And, rising headline inflation. |

“The stagflation cycle is coming to an end. The trend in declining GDP is likely to continue; however, the Hennessee Group believes inflation is topping out and will likely stabilize within the Fed’s acceptable ranges over the next six months. Headline inflation has peaked”, Commented Charles Gradante.

Deflation, Not Inflation

At the last Fed policy meeting “inflation” was stated as the number one concern. The global economy, which remained strong despite U.S. weakness, is now slowing significantly. European Union’s GDP contracted -0.2% in the second quarter. It marked the first time since the early 1990’s that GDP has fallen overall in the countries comprising the European Union. “That signaled deflationary forces are ahead on pricing power and lower interest rates in Europe are expected”, noted Charles Gradante. Four of the world’s five biggest economies are now harboring recessionary woes:

- U.S.

- Euro Zone

- U.K.

- Japan

Hennessee Group’s research concludes that “the U.S. will hold rates into 2009 and the next move will be down, not up, for the Fed Funds”, said Charles Gradante.

About the Hennessee Group LLC

Hennessee Group LLC is a Registered Investment Adviser that consults direct investors in hedge funds on asset allocation, manager selection, and ongoing monitoring of hedge fund managers. Hennessee Group LLC is not a tracker of hedge funds. The Hennessee Hedge Fund Indices® are for the sole purpose of benchmarking individual hedge fund manager performance. The Hennessee Group does not sell a hedge fund-of-funds product nor does it market individual hedge fund managers. For additional Hennessee Group Press Releases, please visit the Hennessee Group’s website. The Hennessee Group also publishes the Hennessee Hedge Fund Review monthly, which provides a comprehensive hedge fund performance review, statistics, and market analysis; all of which is value added to hedge fund managers and investors alike.

Description of Hennessee Hedge Fund Indices®

The Hennessee Hedge Fund Indices® are calculated from performance data reported to the Hennessee Group by a diversified group of over 1,000 hedge funds. The Hennessee Hedge Fund Index is an equally weighted average of the funds in the Hennessee Hedge Fund Indices®. The funds in the Hennessee Hedge Fund Index are derived from the Hennessee Group’s database of over 3,500 hedge funds and are net of fees and unaudited. Past performance is no guarantee of future returns. ALL RIGHTS RESERVED. This material is for general information only and is not an offer or solicitation to buy or sell any security including any interest in a hedge fund.